Which of the Following Both Increase the Money Supply

Bulleted lists are also called _____ lists. It sells Treasury securities which increases the money supply.

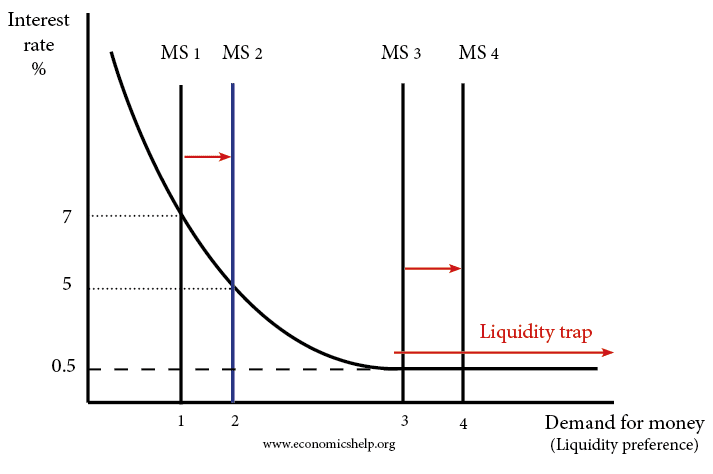

Liquidity Preference Theory Intelligent Economist Theories Preferences Economist

If govt sells securities to the B of E this will lead to an increase in the money supply because banks deposits are seen as liquid assets.

. The Fed can increase the money supply by lowering the reserve requirements for banks which allows them to lend more money. Inflation or the rate at which the average price of goods or services. This will lead to an increase in the MS if the er doesnt increase.

Other things equal if the supply of money is reduced. An increase in the discount rate and an increase in the interest rate on reserves. Which of the following both increase the money supply.

If the Fed wants to increase the money supply it buys government bonds. It lends money to member banks which decreases the money supply. It borrows from member banks which increases the money supply.

A and c e. The Central Bank can increase the demand deposit component of the money supply by _____. Also the interest rate on reserveswhich is what is charged by the Fed and banks when lending can affect how money is given to the customers as if the rate i high it.

B A decrease in the rate of interest. Government sells securities to overseas purchasers. Increase by 20 million and the money supply eventually increases by 200 million.

Which of the following both increase the money supply. It buys Treasury securities which increases the money supply. In real terms the value of this revenue is the change in the money supply divided by the price of goods.

This supplies the securities dealers who sell the bonds with cash increasing the overall money supply. An increase in the discount rate relative to the federal funds rate b. Up to 256 cash back Which of the following both increase the money supply.

Buy bonds to influence the money supply which decreases the interest rate and increases aggregate demand. An open market sale by the Fed d. Fall in repo rate.

Other things the same if the Fed raises the discount rate then banks choose to borrow a. We review their content and use your feedback to keep the quality high. Which of the following will increase the money supply.

Suppose the money supply was initially M and now. Purchase of securities in open market. An increase in the discount rate and an increase in the interest rate on reserves an increase in the discount rate and a decrease in the interest rate on reserves.

The increase will be larger the larger is the reserve ratio. Dollar but increases the. It buys Treasury securities which decreases the money supply.

Inflation can happen if the money supply grows faster than the economic output under otherwise normal economic circumstances. C An increase in the rate of interest. The money supply increases when the Fed A.

The increase will be larger the smaller is the reserve ratio. Decrease in cash reserve ratio. A decrease in the required reserve ratio c.

Sell bonds to influence the money supply which increases the interest rate and decreases aggregate demand. If the US is in a recession and the Fed wants to take action to combat unemployment it can. D A fall in the level of demand.

An increase in the discount rate and an increase in the interest rate on reserves an increase in the discount rate and a decrease in the interest rate on reserves. Question 9 An increase in the money-supply growth rate is certain to increase seigniorage revenues The statement is FALSE. The increase will be larger the larger is the reserve ratio.

A A fall in the level of prices. More from the Fed so reserves increase. The discount rate can be described as the minimum rates of interest which are set by the Federal Reserve in order to lend to the banking institutions and increasing this rate would deter the supply of money in the economy.

Economists studying the money supply categorize the status of the money based on. An increase in the discount rate and a decrease in the interest rate on reserves a decrease in the discount rate and an increase. Other things equal if the supply of money is reduced.

It lends money to member banks which decreases the money supply. Government borrowing financed by increasing money supply. Which of the following will increase the money supply.

It borrows money from member banks which increases the money supply. Decrease by 20 million and the money supply eventually decreases by 200 million. 100 1 rating Transcribed image text.

An increase in paper money reduces the value of the US. The increase will be larger the smaller is the reserve ratio. The Federal Reserve increases the money supply by buying government-backed securities which effectively puts more money into banking institutions.

It sells Treasury securities which decreases the money supply. Which of the following lists two things that both decrease the money supply. View solution Increase in CRR _____ money supply.

Conversely by raising the banks reserve requirements the Fed can decrease the size of the money supply. Seigniorage is revenue received by the government as a result of increasing the money supply. B and c ANSWER.

If the interest rate decreases in an economy it will. When the supply for money increases and the demand for money reduces there will be.

What Is Supply And Demand Curve And Graph Boycewire

Increasing Money Supply Economics Help

Liquidity Preference Theory Intelligent Economist Theories Economist Preferences

No comments for "Which of the Following Both Increase the Money Supply"

Post a Comment